Netflix stands to benefit from the dual strikes underway in Hollywood while competitors like Disney and Apple will get “weaker,” in part because of the streamer’s vast international production pipeline, a top media-stocks analyst said Wednesday on the brink of earnings season.“The strike plays to their advantage,” Michael Nathanson, founding partner of SVB MoffettNathanson, said on CNBC’s “Squawk Box.” “I’ve not been a Netflix bull, but their setup for this quarter and the next 12 months is incredibly strong.”Co-host Andrew Ross-Sorkin seized on that notion, seeking to clarify whether Nathanson meant Netflix would get stronger merely relative to its competition – or if it could help the streamer overall. The answer seemed to be: a bit of both.“I think relative, clearly, right?” Nathanson said.

SVB Showbiz and Celebrity Breaking News

Wall Street Research Firm MoffettNathanson Goes Indie Again After Bankruptcy of Parent Company

Todd Spangler NY Digital Editor MoffettNathanson, a leading Wall Street research outfit covering the media and communications sectors, is once again an independent entity. In December 2021, SVB Financial Group acquired New York-based MoffettNathanson, which was founded in 2013 by analysts Craig Moffett and Michael Nathanson. In March of this year, Silicon Valley Bank — part of SVB Financial Group — collapsed after a run on its assets, leading the parent company to file for Chapter 11 bankruptcy protection.

The CW’s LIV Golf Deal Has Led To Sports Rights Talks With “Everyone” And Potential New Deals As Early As This Fall, Nexstar CEO Perry Sook Says

Perry Sook, CEO of The CW parent Nexstar, said the network’s deal this year to broadcast the Saudi-backed LIV Golf circuit has led to talks with “everyone” in the vibrant sports rights marketplace.

Cord-Cutting Hits All-Time High in Q1, as U.S. Pay-TV Subscriptions Fall to Lowest Levels Since 1992

Todd Spangler NY Digital Editor As streaming video continues its ascendancy, cable, satellite and internet TV providers in the U.S. turned in their worst subscriber losses to date in the first quarter of 2023 — collectively shedding 2.3 million customers in the period, according to analyst estimates. “We are watching the sun beginning to set” on the pay-TV business, SVB MoffettNathanson senior analyst Craig Moffett wrote in a report Friday. With the Q1 decline, total pay-TV penetration of occupied U.S. households (including for internet services like YouTube TV and Hulu) dropped to 58.5% — its lowest point since 1992, two years before DirecTV launched as a new rival to cable TV, according to Moffett’s calculations. As of the end of Q1, U.S. pay-TV services had 75.5 million customers, down nearly 7% on an annual basis.

Roku Ekes Out Revenue Gain of 1% in Q1, Streaming Accounts Grow to 71.6 Million

Todd Spangler NY Digital Editor Roku came in above analyst estimates on the top line for the first quarter of 2023, as it gained 1.6 million active streaming accounts in the period. But the company told investors that the macroeconomic environment was still “challenged” in the quarter. The company posted Q1 sales of $741 million, up 1%, and a net loss of $193.6 million, or $1.38 per share. On average, Wall Street analysts were expecting Roku to post Q1 of $708.49 million and a net loss of $1.37 per share. Click here to sign up for Variety’s free Strictly Business newsletter covering earnings, financial news and more.

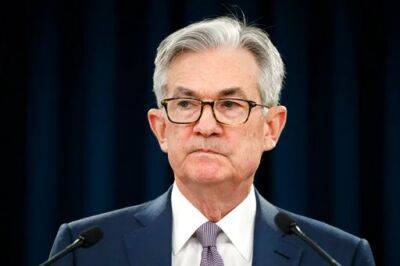

Fed Raises Interest Rates, Possibly For Last Time, Amid Probe Of SVB; Rate Hikes “Were Well Telegraphed And Many Banks Managed To Deal With Them,” Jerome Powell Says

The U.S. Federal Reserve raised interest rates today for the ninth time since last year by an expected 25 basis points, or 0.25%. But Fed chief Jerome Powell indicated slow to no more rate hikes in this latest cycle as tighter credit conditions following the recent bank crisis may help tame inflation without more Fed action.

As Federal Reserve Mulls Interest Rate Hike After Bank Failures, Frontline Correspondent James Jacoby Explains How Fed’s “Culture Of Secrecy” Threatens Hollywood And Big Tech

The Federal Reserve is expected to raise interest rates again on Wednesday, continuing its year-long push to curb inflation. But that balance is more elusive than ever given the failures of Silicon Valley Bank and Signature Bank and subsequent meltdowns tied to the new rate environment.

John Oliver Guts SVB & Signature Bank Collapses, & Yes, There’s Another Fox News Shiv Too

It looked like a good week for Fox News on Last Week Tonight with John Oliver today as the collapse of Silicon Valley Bank and uncertainty in the financial world replaced the searing revelations resulting from Dominion Voting’s lawsuit against the Rupert Murdoch-owned cable newser on the HBO series.

Sharon Stone breaks down in tears on stage after sharing devastating news

Sharon Stone broke down in tears on Thursday, as she revealed that she had recently lost "half of my money" after "that banking thing".Although the 65-year-old did not elaborate, as she encouraged guests to text and donate money during the Women’s Cancer Research Fund’s (WCRF) An Unforgettable Evening fundraiser, the actress called herself a "technical idiot"."I know that thing that you have to get on and figure out how to text the money is difficult. I’m a technical idiot, but I can write a [expletive] check.

Chris Hayes Slams Right-Wing Media for Saying SVB Failed Due to ‘Wokeness’: ‘Equal Parts Offensive and Preposterous’ (Video)

Who Killed Silicon Valley Bank?““Was there regulatory failure? Perhaps. SVB was regulated like a bank but looked more like a money-market fund,” Kessler wrote. “Then there’s this: In its proxy statement, SVB notes that besides 91% of their board being independent and 45% women, they also have “1 Black,” “1 LGBTQ+” and “2 Veterans.” I’m not saying 12 white men would have avoided this mess, but the company may have been distracted by diversity demands.”Hayes couldn’t hold back his laughter.

‘The New Americans: Gaming A Revolution’ Review: Ondi Timoner’s Provocative Doc Previews The World That Awaits Us – SXSW

Wanna feel old? Contrary to popular depictions of millennial youth as being disenfranchised, politically feckless and bone idle, this eye-opening documentary might be the bazooka that’s needed to shatter all those cozy assumptions. So of-the-moment is Ondi Timoner’s latest work that it premiered almost exactly when the collapse of SVB made international news, and though that particular eventuality isn’t foreseen here, it won’t take much post-festival fine-tuning to bring her film bang up to date.

Fallon Jokes Trump Would Know How to Handle SVB Crash: ‘Need a President With Experience of Multiple Bankruptcies’ (Video)

the bank told investors it needed to raise just over $2 billion to offset $1.8 billion in losses, leading to a number of high-profile venture capital clients pulling their assets from the bank, totaling a staggering $42 billion. As a result SVB was left with a negative cash balance of $958 million.

Meyers Says SVB Collapse Is Just the Latest Mystery in ‘A Super Boring Game of Clue': ‘Of F–ing Course It Was Trump’ (Video)

the bank told investors it needed to raise just over $2 billion to offset $1.8 billion in losses. On Thursday, dozens of SVB’s venture capital clients — at the urging of, among others, billionaire Peter Thiel — started pulling their assets from the bank.In the end, these customers withdrew a staggering $42 billion, and as a result SVB was left with a negative cash balance of $958 million.

BuzzFeed Has Most of Its Cash in Failed Silicon Valley Bank

it had approximately $487 million held by Silicon Valley Bank. The company said that the number represents approximately 26% of its cash and cash equivalents, and the company will be able meet its pending financial obligations for at least “the next 12 months and beyond.”The Santa Clara-based Silicon Valley Bank was closed Friday by the California Department of Financial Protection and Innovation, marking a major ending to what had for decades been one of the pillars of financing in the tech industry economy.The bank first made headlines Wednesday after it notified investors that it needed to raise just over $2 billion to offset $1.8 billion in losses it incurred from investments in mortgage-backed securities, which were devalued thanks to the Fed’s decision to raise interest rates.The next day, dozens of SVB’s venture capital clients — urged on by a venture capital fund founded by billionaire Peter Thiel and others — started pulling their assets from the bank, which one investor previously described as “a hysteria-induced bank run.”The customers withdrew $42 billion by the end of Thursday, according to California regulatory filings, and as a result the bank was left with a negative cash balance of $958 million.

Second Bank Fails In Spreading Crisis; Feds Say Depositors At Both Will Be “Made Whole”

New York State regulators took over Signature Bank today, the second financial institution to fold in less than a week as the FDIC and Treasury, however, assured depositors at both that they would be made whole in an attempt to stem the growing crisis.

SVB Bank Crisis: Federal Reserve, Treasury Department and FDIC Take Steps to Protect Depositors Amid Meltdown

Cynthia Littleton Business Editor The federal government has stepped up efforts to contain the damage of the collapse of Silicon Valley Bank by assuring that all depositors to the bank will have access to all of their money as of March 13. The Treasury Department, Federal Reservce and FDIC put out a joint statement on Sunday to assure markets that all SVB depositors will be protected from losses as the bank faces an exodus of customers. The statement also reinforced that the government’s safety net does not extended to SVB shareholders, senior managers or “certain unsecured debtholders.” “No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer,” the statement ready. “After receiving a recommendation from the boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors. Depositors will have access to all of their money starting Monday, March 13.”

Wrapbook, Hollywood Production Payroll Company, Among Those Hit By Silicon Valley Bank Collapse

Hollywood production payroll company Wrapbook is among those affected by this week’s collapse of Silicon Valley Bank (SVB), which has now been taken over by the Federal Deposit Insurance Corporation.

SVB Collapse Hits Hollywood Payroll Firm Wrapbook, Which Says Payments Will Be Delayed by Bank’s Shutdown

Todd Spangler NY Digital Editor In the wake of the sudden collapse of Silicon Valley Bank, Wrapbook, a company that provides payroll services for TV and film productions, said payments submitted through its platform will be subject to delays. In messages to clients Friday, Wrapbook said payroll-processing delays caused by the failure of SVB — which came after a historic run on the bank’s deposits — may continue into next week. The shutdown of SVB “will cause payroll to be delayed today, March 10th 2023, and impact the processing of uncashed checks,” Wrapbook said in a statement. The company said it is working to resume payroll processing with SVB while at the same time seeking to process payroll payments with another banking partner.

Roku Says $487 Million of Its Cash, or 26%, Was Held in Failed Silicon Valley Bank

Todd Spangler NY Digital Editor About one-fourth of Roku’s cash and equivalents — nearly half a billion dollars — has been held in Silicon Valley Bank (SVB), which was shut down by financial regulators Friday after it collapsed. And the streaming platform company said it’s unsure the extent to which it will be able to recover that cash. SVB, after it faced a run on deposits and failed to raise capital to make up the shortfall, was closed by the California Department of Financial Protection and Innovation, which appointed the FDIC as receiver of its assets. Roku disclosed in an SEC filing that about $487 million of its $1.9 billion in cash and equivalents is held at SVB, or about 26% of the company’s cash and cash equivalents balance as of March 10. The remaining $1.4 billion is “distributed across multiple large financial institutions,” Roku said in the filing.

Roku Had One-Fourth Of Its Cash In Failed Silicon Valley Bank, Most Of It Uninsured; Streaming Giant Says It Can Still Meet Expenses

The biggest bank failure since the financial crisis 15 years ago has hit streaming giant Roku.

MoffettNathanson, Leading Independent Wall Street Media Research Firm, Acquired By SVB Financial

MoffettNathanson LLC, the New York-based Wall Street research firm led by star financial analysts Craig Moffett and Michael Nathanson, has been acquired by SVB Financial, a holding based in Santa Clara and parent of Silicon Valley Bank.

Popular Topics

Our site popstar.one offers you to spend the best time ever reading SVB latest news. Enjoy scrolling SVB celebrity news and gossip, photos, videos, scandals, and more. Stay tuned following daily updates of SVB stuff and have fun. Be sure, you will never regret entering the site, because here you will find a lot of SVB news that will never disappoint you!